Cost of delaying your retirement planning

Compounding (Source: Stanlib-Wealth for life)

Having time on your side also means that you can depend on the power of compounding. Compounding starts when the income (interest or dividends) you earn from the underlying securities in your investment are added back to your investment account. The greater value then attracts further income and you are then earning income on your income.

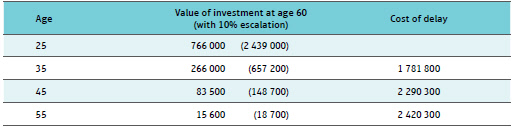

The power of compounding can be seen in this example in which an investor starts investing R200 a month at different ages. Investment growth is assumed to be an average of 10% per year.

*Costs and charges excluded. These values are for illustrative purposes only and are not guaranteed.Source: Stanlib-Wealth for Life

The cost of delaying your retirement planning can be astronomical. Starting your retirement investing at the age of 45 in this case would mean a loss of retirement savings of R2 290 300. If you have already left it late to start saving for your retirement, you should consider putting away as much as you can possibly afford. So, where a 25 year old should aim to save about 15% of their earnings, a 45 year old would have to save 47% of their earnings to achieve the same financial position at retirement as a 25 year old.

Successful retirement saving = starting early or saving more, combined with sticking to a clear investment strategy. Source: Stanlib-Wealth for Life